Not known Details About Medigap

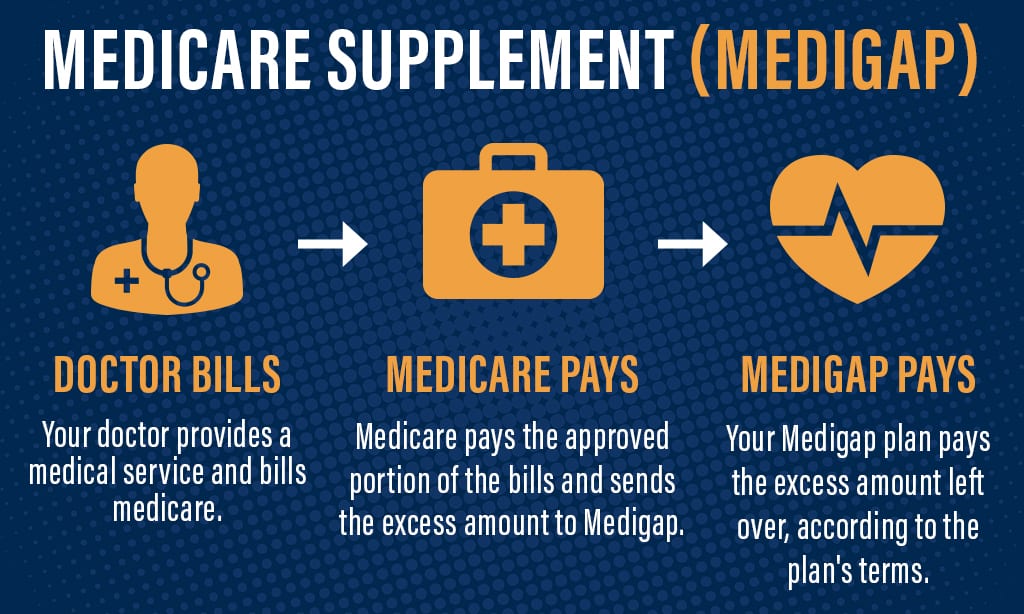

Medicare Select is a sort of Medigap policy that requires insureds to use particular health centers and also in some instances details medical professionals (other than in an emergency situation) in order to be qualified for complete benefits. Various other than the restriction on healthcare facilities as well as service providers, Medicare Select policies must fulfill all the needs that use to a Medigap plan.

When you utilize the Medicare Select network medical facilities and providers, Medicare pays its share of approved costs as well as the insurance provider is accountable for all extra benefits in the Medicare Select plan. Generally, Medicare Select policies are not called for to pay any type of advantages if you do not make use of a network service provider for non-emergency solutions.

The Best Guide To What Is Medigap

What actually surprised them was the awareness that Medicare would certainly not cover all their wellness treatment costs in retirement, including those when traveling abroad. "We take a trip a whole lot and also desire the safety and security of understanding we can obtain clinical therapy far from house," claims Jeff, that with Alison is looking forward to seeing her family members in England.

The Ottos realize that their requirements might transform in time, particularly as they stop itinerary as they grow older. "Although we have actually seen prices boost over the last 2 years given that we enrolled in Medigap, we have the best degree of supplemental protection for now as well as think we're getting great worth at $800+ each month for the both people consisting of oral insurance coverage," claimed Alison.

For residents in select states, register in the appropriate Medicare prepare for you with help from Integrity Medicare Solutions.

Some Known Factual Statements About Medigap

Yet we can give you a basic concept. And also, however for your kid, it might be a quite significant drop relying on just how late he was with the repayments. According to the website Credit Karma, someone with a see this page credit rating rating comparable to your boy's will certainly see anywhere from a 25 to 85-point drop if a bank card repayment is greater than 30 days late.

The only means to claw his method back to around 690 is to start making settlements promptly (as well as, ideally, in full), along with just using regarding 10 to 30 % of his available credit history every month (Medigap benefits). And he needs to be person: Credit history score healing time from missed out on payments normally takes around 18 months.

Medicare Supplement Plan N minimizes just how much Original Medicare enrollees have to pay navigate to these guys of pocket for healthcare. For instance, Strategy N pays 100% of the coinsurance for a hospital stay (Medicare Component A) and healthcare (Medicare Component B). Plan N, one of 10 Medicare Supplement or Medigap plans, gives greater protection than many of the other extra intend on the market.

The Main Principles Of What Is Medigap

Amongst various other advantages, Plan N covers the coinsurance expenses for Medicare Component A, Medicare Part B, hospice treatment as well as experienced nursing centers. This means that rather than an enrollee being billed 20% of view it the expense, as would certainly occur with Initial Medicare, the additional plan would pay that 20% of the costs.

It is essential to keep in mind, nevertheless, that plans marketed by insurance provider are standard throughout the nation, suggesting a Strategy N plan sold by Aetna covers the same core benefits as a Plan N policy sold by Cigna or a different carrier. Medicare Parts An and B pay their share of medical expenses, usually 80% of costs.

Furthermore, its copays do not count toward meeting the Part B deductible (What is Medigap). The majority of Strategy N plans do not bring a separate deductible apart from the Component B insurance deductible. Strategy N likewise does not cover Medicare Part B excess charges the quantity providers can bill beyond Medicare costs if they do decline Medicare-approved prices.

We suggest Plan N if you desire reduced regular monthly costs and also agree to have some costs for medical treatment like medical professional visits. Plan G is a better alternative if you're ready to pay more each month for a strategy that gives the most detailed coverage for new enrollees.

What Does What Is Medigap Do?

With Strategy N, low-end customers of health and wellness solutions may come out ahead. High-end customers of healthcare services will have a different experience. Let's state, for instance, that a Strategy N costs $150 in monthly premiums while a Plan G prices $200 a month, causing $50 each month in cost savings for Plan N.